Everyone hits the same wall around 1,000 grant recipients: your payment tools can’t keep up with your mission. You’re running high-volume nonprofit payouts through systems built for sequential invoice processing, which means your program team identifies beneficiaries in hours while your finance team needs weeks to push payments through. The spreadsheet chaos tells the story: exporting data from your grants software, reformatting it to match payment templates, then maintaining separate trackers to see which disbursements actually cleared. When a disaster relief program needs to disburse housing assistance to 10,000 families, there’s no invoice to match and no time for approval queues.

TLDR:

- Nonprofits hit infrastructure failure at 1,000+ monthly disbursements when invoice tools force grant distributions through approval chains designed for vendor payments.

- Traditional systems require manual tax form collection that takes 3 months at 1,000 recipients versus 3 weeks at 100.

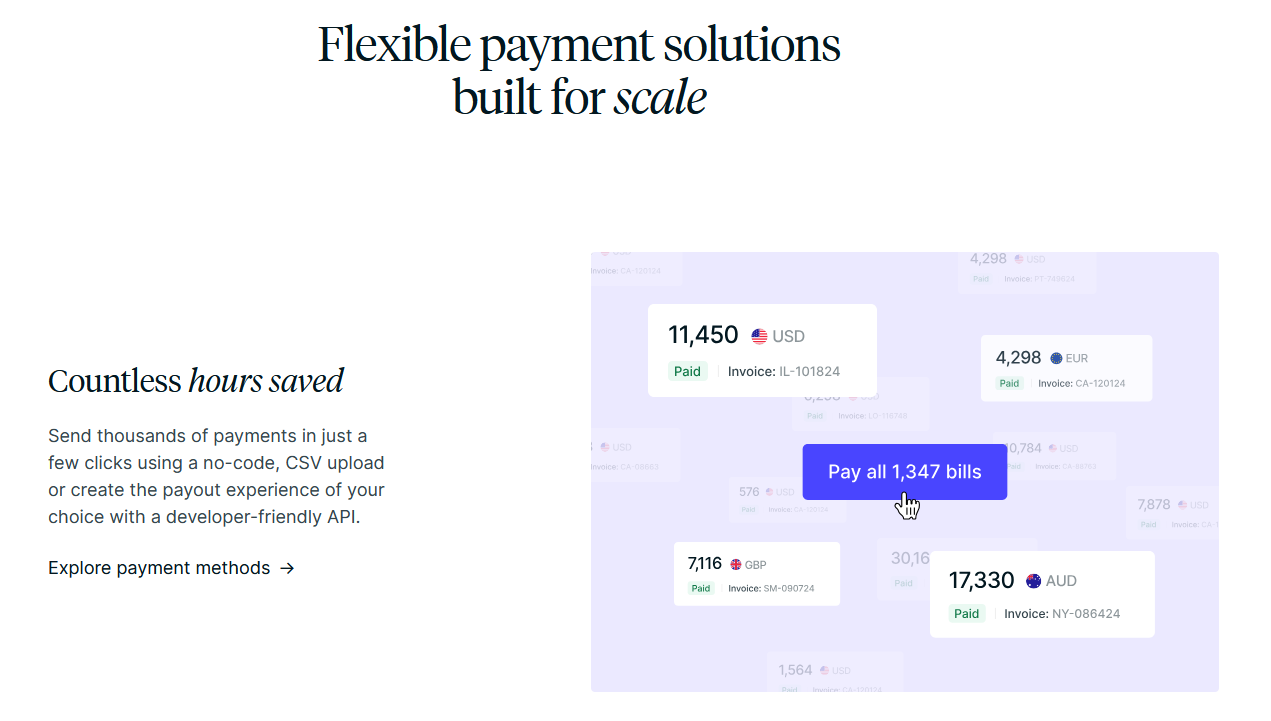

- CSV upload enables operations teams to disburse 5,000 payments across 220+ countries in 90 seconds without engineering resources.

- API-first disbursement infrastructure syncs payment status back to grants management systems in real time, closing the gap between approval and funds delivered.

- Routable processes high-volume nonprofit payouts across 140+ currencies with bi-directional Sage Intacct sync and human support via Slack when regional banking restrictions arise.

When Your Nonprofit Hits 1,000 Recipients: The Breaking Point for Traditional Payment Tools

The number 1,000 isn’t arbitrary. It’s the threshold where payment infrastructure built for traditional vendor management collapses under the weight of grant distribution velocity. Most inherited tools were designed for paying 50 suppliers monthly, not distributing emergency aid to 5,000 families weekly across continents.

Traditional payment tools treat every disbursement like an invoice requiring approval chains, PO matching, and line-item reconciliation. That friction works at 200 transactions per month. At 1,000+ recipients, those workflows become mission-critical bottlenecks. Your program team can identify beneficiaries faster than finance can process payments.

The breaking point reveals itself in spreadsheet chaos: exporting CSVs from grants management software, manually reformatting data to match upload templates, then cross-referencing separate trackers to see which disbursements cleared. Every batch requires someone fielding Slack messages about payment status while reconciling failures from misspelled bank names or rejected routing numbers.

Invoice-centric systems assume time for sequential processing. They’re built for deliberate monthly closes, not rapid-response disbursements where 72-hour turnaround times determine whether a rural health clinic stays operational.

High-growth nonprofits need what marketplaces already figured out: mass payout infrastructure treating disbursements as programmatic operations, not accounting exceptions.

The Infrastructure Mismatch: Why Invoice Tools Cannot Handle Grant Velocity

Invoice-based systems were built around a control-first philosophy: delay payment until multiple stakeholders verify legitimacy. Three-way matching compares purchase orders, receiving documents, and invoices before releasing funds. Multi-tier approval chains route each transaction through department heads, then finance managers, then executives based on dollar thresholds.

This sequential verification model protects against fraudulent vendor invoices. But grant recipients aren’t vendors submitting invoices. They’re pre-vetted beneficiaries awaiting promised funds. The architectural assumption breaks.

When a wildfire relief fund needs to disburse housing assistance to 10,000 displaced families, there’s no invoice to match. No purchase order to reference. No receiving document to verify. The verification already happened during grant application review. Payment should execute immediately.

Disaster relief payment systems across the United States face dangerous delays, with survivors receiving initial small disbursements but waiting weeks, months, or years for subsequent funds. These aren’t operational inefficiencies. They’re consequences of forcing grant distributions through infrastructure designed for vendor invoices.

Mass disbursement infrastructure inverts the model: verification precedes batch creation, then payments execute programmatically. One CSV upload or API call triggers thousands of simultaneous transfers. No approval queues. No sequential processing delays.

The Compliance Burden That Scales Exponentially (Not Linearly)

Manual W-9 collection handles 100 disbursement recipients in three weeks: emailing requests, chasing responses, validating TINs, and generating 1099-NECs. Scaling to 1,000 recipients stretches the process to three months, pushing 1099 filing into March. This leaves the team unable to run new cycles, address emergency funding, or support program growth.

The burden multiplies beyond volume. International grantees require W-8BEN forms and 1042-S filing. Watchlist screening against OFAC sanctions lists becomes mandatory at scale. Each manual check takes 15 minutes—that’s 1,250 hours for 5,000 recipients.

Automated disbursement systems collect W-8/W-9s during onboarding before first payment. TIN validation happens programmatically against IRS records. Watchlist screening runs in seconds across 6,000+ databases. Tax filing data exports ready for submission without manual spreadsheet assembly.

The CSV Revolution: No-Code Mass Disbursements for Resource-Constrained Teams

Most nonprofits don’t have engineering teams. They have program directors who live in Excel, grants managers who track disbursements in Google Sheets, and finance coordinators juggling multiple spreadsheets. API integrations aren’t happening—not because they wouldn’t help, but because there’s nobody to build them.

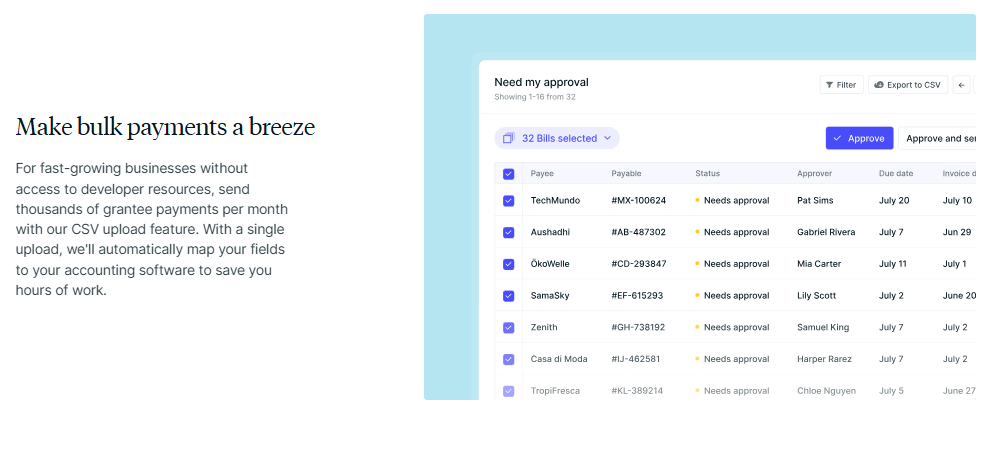

CSV upload turns payment infrastructure into something program teams can operate directly. Export 5,000 recipient records from your grants management system. Map columns to payment fields. Upload one file. Disbursements process across 220+ countries in 140+ currencies without requiring developer hours.

Pre-upload validation catches issues before money moves: duplicate bank accounts, invalid routing numbers, missing tax documentation, watchlist flags. You fix data errors in your spreadsheet and re-upload, not troubleshoot failed transfers after the fact.

Field mapping remembers your column structure. The second batch takes 90 seconds: export, upload, review, submit. No reformatting. No manual entry. Your operations team can own the entire disbursement cycle while finance maintains oversight through real-time dashboards.

When API-First Infrastructure Becomes Non-Negotiable

CSV uploads fail when grant distributions become daily operations instead of monthly events. Processing multiple disbursements per day through manual file uploads creates bottlenecks where program teams wait for finance to clear yesterday’s batch before submitting today’s requests.

The breaking point arrives when payment status must sync back into your grants management system in real time. Case workers need immediate confirmation that emergency housing funds cleared before closing recipient files. Program dashboards require live disbursement completion rates without manual reconciliation.

API connections trigger payments automatically when your grants software completes approvals. Status updates return instantly: payment initiated, funds cleared, recipient confirmed. Zero export-upload-import loops.

Emergency response programs cannot absorb the delays CSV workflows create. API integration closes the operational gap between grant approval and funds delivered.

The Global Reach Requirement: Why Domestic-Only Systems Fail International Missions

Domestic payment rails work until your mission crosses borders. ACH transfers cannot reach recipients without US bank accounts. Check mailing to 80 countries means navigating postal reliability variance and weeks-long clearance windows. Wire transfers price small disbursements into operational impossibility at $45 per transaction.

Mongabay faced this constraint paying journalists across 220+ countries. Their previous system forced workarounds: asking recipients to open US accounts, batching payments monthly to reduce wire fees, or manually researching local transfer services country by country. Each workaround added delays between story completion and writer compensation.

International coverage isn’t expansion planning. Refugee resettlement organizations cannot ask displaced families to acquire US bank accounts before receiving assistance. Global health programs distributing funds to rural clinics need local rail compatibility, not SWIFT wires that cost more than the grants themselves.

Effective disbursement systems route payments through the recipient’s local banking infrastructure: local rails in 140+ currencies across 220+ territories. The system adapts to recipient location rather than forcing recipients to adapt to your payment constraints.

Real-Time Visibility: Why “Payment Sent” Is No Longer Enough

Program teams managing 1,000+ disbursements can’t operate when recipients call asking when funds arrive, case workers need confirmation before closing files, and funders demand proof of timely delivery. Legacy systems treat payment status as binary: pending or complete. The gap between those states spans days where money exists in banking limbo, preventing you from diagnosing failed transfers or proving to oversight boards that delays stemmed from banking issues.

Real-time tracking surfaces granular status updates: payment initiated, funds debited, transfer in progress, recipient bank accepted, funds cleared. Webhook notifications push updates to your grants management system automatically, reflecting live completion rates without manual reconciliation.

Failed transfers trigger immediate alerts so you can request corrected banking details before recipients notice delays. Stuck payments reveal patterns where certain countries face clearance issues or specific recipient banks reject transfers, letting you route future disbursements differently. Recipients access self-service portals showing exactly when payments arrive, eliminating status inquiry calls.

How Routable Powers High-Volume Nonprofit Disbursements Without Adding Headcount

Mongabay’s switch from Bill.com wasn’t about cheaper fees. It was about infrastructure that couldn’t scale mission work. When you’re paying journalists across 220+ countries and crises block payment channels overnight, help docs don’t solve problems. You need someone on Slack who can reroute funds through alternate rails before your contributor misses rent.

Routable treats nonprofit payouts like marketplace operations. CSV uploads or API calls trigger thousands of payments across 140+ currencies, while ERP and accounting integrations maintain real-time ledger parity without manual reconciliation. Recipient tracking shows exactly when funds clear, and when exchange-rate shifts or regional banking restrictions arise, you can reach real humans via email or Slack to build custom payment paths.

High-volume nonprofits don’t need better invoice tools. You need payout infrastructure where disbursement velocity determines mission impact. Processing 5,000 monthly grants shouldn’t require three more finance coordinators.

Final Thoughts on Payment Infrastructure That Supports Mission-Critical Disbursements

Your nonprofit hit 1,000 recipients because your programs work and your mission matters. Grant distributions shouldn’t slow down when you scale from 200 monthly payments to 5,000 weekly disbursements across continents. Infrastructure built for vendor invoices can’t handle the velocity humanitarian work demands.

Talk to our team about disbursement systems designed for nonprofits processing mass payouts, not procurement departments paying suppliers.

FAQ

How do I know when my nonprofit has outgrown invoice-based payment tools?

When you’re processing 1,000+ monthly disbursements, traditional tools built for vendor invoices create bottlenecks that delay mission-critical payments. The clearest signal is spending more time managing payment workflows than executing your programs—exporting CSVs, manually reformatting data, and fielding recipient status calls instead of serving beneficiaries.

What’s the difference between API and CSV upload for grant distributions?

CSV upload lets program teams without developers export recipient lists from your grants software, map columns once, and process thousands of payments with a single file. API connections automate the entire flow, triggering disbursements when your system completes approvals and syncing payment status back in real time without manual exports or imports.

Can I pay grant recipients internationally without using expensive wire transfers?

Yes—modern disbursement systems route payments through local banking rails in 140+ currencies across 220+ territories, avoiding the $45+ wire fees that make traditional international transfers cost-prohibitive for small grants. Recipients receive funds in their local currency through their existing bank accounts without opening US accounts.

How does automated tax compliance work at high disbursement volumes?

Automated systems collect W-9 forms during recipient onboarding before first payment, validate TIN numbers programmatically against IRS records, and run watchlist screening across 6,000+ databases in seconds. At year-end, 1099-NEC and 1042-S filing data exports ready for submission without manually assembling spreadsheets or chasing missing tax forms.

Why do disaster relief programs need real-time payment tracking?

When distributing emergency aid to thousands of families, program teams can’t wait days to confirm funds cleared before closing recipient cases. Real-time tracking shows granular status (initiated, in progress, cleared) and triggers immediate alerts when transfers fail, letting you request corrected banking details before recipients notice delays or funders question disbursement timelines.