The annual tax season brings a “fun” and familiar challenge for accounting teams everywhere: preparing and filing 1099 forms. If you spend countless hours manually handling these tax documents, there’s a better way forward. Let’s explore how online filing and automation can make this time-consuming process more manageable while improving tax compliance.

Note: While automation significantly improves the 1099 filing process, always consult with your tax professional regarding your specific filing requirements and obligations. This article is neither legal advice nor tax advice. We recommend that you speak to your tax advisor with any questions or concerns around tax reporting.

TLDR:

- Automate 1099 filing to eliminate manual data entry and year-end scrambles with real-time TIN validation.

- E-filing is mandatory for 250+ returns and offers faster processing with immediate IRS confirmation.

- Collect W-8/W-9 forms during vendor onboarding to avoid missing tax documents at filing deadlines.

- Routable automates tax form collection, compliance checks, and generates e-filing reports in minutes.

Types of 1099 Forms

The IRS uses 1099 forms to track different types of income. The most common forms include:

Who Needs a 1099?

For 2025, you’ll need to file 1099s for any vendor, contractor, or service provider who received $600 or more from your business during the tax year. However, starting in 2026, the threshold increases to $2,000 due to the One Big Beautiful Bill Act. Understanding how to pay 1099 employees properly is key to staying compliant.

This includes:

- Freelancers and independent contractors

- Attorneys and legal service providers

- Rent payments to property owners

- Service providers who aren’t corporations

- Other businesses that provided services to your company

Some payees may receive multiple 1099 forms if they earn different types of income from your platform (e.g., service fees on 1099-NEC and referral bonuses on 1099-MISC).

Foreign contractors require Form 1042-S instead of 1099s, with different withholding rules and deadlines.

How Do You File a 1099 with the IRS?

For platforms managing hundreds or thousands of payees—whether they’re creators, drivers, or service providers—the 1099 filing process can quickly become overwhelming. Understanding the basic steps helps you identify where automation can eliminate bottlenecks and reduce errors.

Filing 1099s involves several key steps:

- Gather necessary vendor information (W-8/W-9 forms)

- Verify Tax Identification Numbers (TINs)

- Calculate total payments for the year

- Complete the appropriate 1099 forms

- Submit forms to the IRS electronically or by mail

- Distribute copies to recipients

- Send copies to state tax agencies when required

Can You File a 1099 Electronically?

Yes! Not only can you file 1099s electronically, but it’s becoming the preferred method for the IRS. Electronic filing is now mandatory if you’re submitting 10 or more information returns (reduced from the previous 250 threshold), but businesses of any size can benefit from e-filing.

Benefits of Filing 1099s Online

Making the switch to online filing offers plenty of advantages:

- Immediate confirmation when the IRS receives your forms

- Reduced paper waste and storage needs

- Lower processing costs compared to paper filing

- Faster turnaround time

- Decreased chance of forms getting lost in transit

- Better accuracy rates

Understanding 1099 Automation

For platforms managing thousands of payouts to creators, drivers, or gig workers, real-time visibility becomes critical. Automated 1099 systems track every payment from initiation through completion, creating an audit trail that connects directly to tax reporting. When a creator questions their annual earnings or a driver disputes their 1099 amount, you can instantly pull up transaction history without digging through spreadsheets. This transparency builds trust with your payee network while protecting your platform during audits. The system automatically flags discrepancies between payment records and tax forms before filing, giving you time to resolve issues rather than discovering them during an IRS inquiry.

Automated 1099 processing transforms the tax filing processing from a year-end scramble into an automated, year-round system that works quietly in the background.

Key Form Types

- Primary focus on 1099-MISC and 1099-NEC forms

- Automatic categorization of payments

- System assigns appropriate form type based on vendor and payment data

Error Prevention & Validation

- Real-time tax ID number validation

- Automatic checks for missing information

- Early alert system for potential issues

- Proactive problem-solving before deadlines

Audit & Record-Keeping Benefits

- Complete digital paper trail

- Easy access to historical records

- Simplified audit preparation

- Efficient vendor dispute resolution

- Elimination of manual record-keeping

Common 1099 Filing Challenges for High-Volume Platforms

Platforms managing thousands of payees face unique obstacles during tax season. Missing or outdated W-9 forms create bottlenecks when payees change addresses or update their business structure. Manual TIN validation catches errors too late, resulting in rejected filings and penalty notices from the IRS.

Payment categorization becomes complex when the same payee receives multiple payment types—service fees, bonuses, and reimbursements all require different 1099 treatment. Tracking these distinctions across thousands of transactions without automation leads to misclassified payments and compliance issues.

International payees add another layer of complexity. Determining who needs a 1099-NEC versus a 1042-S, collecting the appropriate W-8 forms, and applying withholding rules correctly requires specialized knowledge that most operations teams don’t have readily available.

How Routable’s 1099 Automation Works

Routable has tax compliance built into the payment infrastructure itself from the moment a payee joins your platform through final IRS filing. The system handles vendor onboarding, payment tracking, compliance verification, and e-filing preparation as a unified workflow, not disconnected steps.

Let’s break down how automation actually works in practice with Routable:

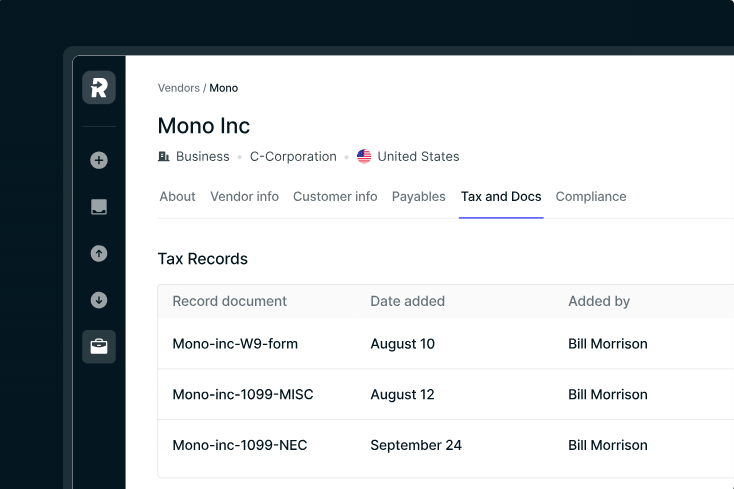

- Vendor onboarding: Tax forms and information are collected automatically and stored securely during initial setup, eliminating manual data entry.

- Compliance verification: The system automatically verifies TIN numbers and checks vendor information against global watchlists.

- Data collection and review: Easily see which vendors are missing tax forms, request the forms in bulk, and payment records are cross-referenced with your ERP system.

- Smart filtering: Choose which data to export with filters for multiple 1099 and 1042 document types.

- Export and filing: Generate e-filing compatible reports with just a few clicks, ready for submission through services like Tax1099 and Track1099.

Conclusion

The days of manual 1099 processing are numbered. By embracing automation, your business can turn tax season from a dreaded annual challenge into a smooth, efficient process. The benefits extend beyond just saving time – you’ll improve accuracy, reduce stress on your accounting team, and maintain better relationships with your vendors.

Ready to revolutionize your 1099 filing process? Consider exploring automation solutions that can handle everything from initial vendor onboarding to final filing. The sooner you make the switch, the sooner you can stop dreading tax season.

Note: While automation significantly improves the 1099 filing process, always consult with your tax professional regarding your specific filing requirements and obligations. This article is neither legal advice nor tax advice. We recommend that you speak to your tax advisor with any questions or concerns around tax reporting.

FAQ

What’s the difference between 1099-NEC and 1099-MISC forms?

1099-NEC is specifically for independent contractor compensation, while 1099-MISC covers other miscellaneous payments like rent or attorney fees. Automated systems categorize payments and assign the correct form type based on your vendor and payment data.

How can I avoid missing W-9 forms at tax filing deadlines?

Collect W-9 forms during vendor onboarding instead of waiting until year-end. This approach captures tax information when you first set up creators, drivers, or service providers in your system, eliminating last-minute scrambles.

When is e-filing 1099s required instead of paper filing?

E-filing becomes mandatory when you submit 10 or more returns to the IRS. However, businesses of any size can benefit from electronic filing through faster processing, immediate IRS confirmation, and better accuracy rates.

Can automation handle TIN validation before I file?

Yes, automated systems validate Tax Identification Numbers in real-time throughout the year rather than at filing time. This catches errors early and prevents rejected forms, giving you time to request corrected information from payees.

How long does it take to generate e-filing reports with automation?

With payment automation platforms, you can generate IRS-ready e-filing reports in minutes. The system filters data by form type (1099-NEC, 1099-MISC, 1042-S), cross-references your payment records, and exports files compatible with e-filing services.