If you’re running a creator platform, gig marketplace, or royalty distribution network, your payment infrastructure isn’t just a back-office function—it’s core to your product. When you’re disbursing to thousands of freelancers, contractors, or creators every month, payment speed, transparency, and reliability directly impact payee retention and platform growth. Whether you’re running a creator platform, gig economy marketplace, or royalty distribution network, your payment infrastructure needs to scale without adding headcount, and your payees expect fast, transparent disbursements.

If you’re building or scaling a platform that relies on mass payouts to freelancers, understanding payment rails, tax compliance, and payee experience isn’t just a back-office concern, it’s core to your product. This guide covers everything technology operators need to know about paying independent contractors at scale: from choosing the right payment methods and automating tax compliance to optimizing the payee onboarding experience that keeps your network engaged.

TLDR:

-

Instant payments offer the fastest deposits for mass payouts, allowing funds to move instantly between bank accounts, 24/7/365.

-

Automate W-8/W-9 collection during onboarding and 1099-NEC filing by February 2 to avoid IRS penalties at scale.

-

Let payees choose their payment method (ACH, instant payments, PayPal) to improve retention and satisfaction.

-

Use API-first payment infrastructure to handle 10,000+ monthly payouts without manual processing.

-

Freelancers file self-employment taxes quarterly—never withhold payroll taxes from contractor payments.

-

Routable automates mass payouts with fast payee onboarding, multiple payment rails, and developer-friendly APIs.

Worker classifications and tax implications

What is a Freelancer or Independent Contractor?

The freelance economy is booming. As of 2025, approximately 45% of the American workforce is freelancing, with the workforce continuing to grow due to benefits like flexible schedules, work-from-anywhere opportunities, earning extra money, and project selection.

This shift shows no signs of slowing: freelancers collectively generated $1.5 trillion USD in earnings in 2024, and projections suggest they’ll represent over 50% of the U.S. workforce by 2027.

Somewhat interchangeable, the terms freelancer and independent contractor typically refer to a third-party person hired by a business to complete a series of tasks or a longer project that is adjacent to the principal business of the company. Freelancers represent an independent, small business, usually consisting of just one person who is working as a sole proprietor and has no employees. Similarly, an independent contractor can be a sole proprietor hired to work on a project though the duration of that project tends to be longer than that of freelance work.

What is a W-2 Contractor?

In some scenarios, an independent contractor could also refer to employees who are hired by a business for a specific task during a predetermined window of time. Some temp workers ultimately gain full time employment status with a business, but it is not the expectation for either the worker or business. Sometimes the “temp” worker or consultant files a W-2 with their primary business, but is considered a contractor to the client that hires the agency. In other instances, temp workers are temporarily hired by the business who will deduct taxes and be treated closer to a regular employee. The determination for how payment is rendered to the temp worker is agreed upon upfront.

How Are Employees Different?

What it really comes down to is the overall involvement of a business in the work of the person hired for how employee status is determined. While employees of a company are subject to defined work hours and company regulations with access to benefits, freelancers work independently with little oversight, can set their desired hours, and can complete the work in the manner of their choosing. Further, freelancers are responsible for filing their own taxes and independently creating retirement plans and healthcare options.

How to Pay Freelancers and Independent Contractors

Freelancers have desired compensation in mind when they submit a bid for work based on a few different factors like experience, market trends, workload, and timeline. Here are some things to keep in mind when reviewing a freelancer’s bid. Determine which of these options best fit the business need upfront before any work begins.

Reach an Agreement on Pay Rates

The first element in paying independent contractors is to determine a rate for payment by looking at the workload that needs to be completed and in what time frame. A less experienced freelancer will charge a lower rate, but overall quality may differ from that of a more experienced person. A middle-of-the-road rate for a project could be impacted by a tighter deadline. Other factors that a freelancer may point to for a rate include industry accepted guild rates, complexity of a project, and longevity of contract.

Hourly vs. Project-Based

Hourly rates are determined by the amount of time it takes to complete a project. Hourly rates are best applied to projects that have specific windows of work or when the hiring business has more visibility of the timeline. For example, temp workers hired to check-in attendees to a fundraising event will be paid hourly due to the definite time frame of the event.

Project-based rates are the total projected cost of a project, beginning to end. This rate is best used for open-ended projects where the amount of time spent to complete the project is subjective. For example, hiring a marketing consultant to create a branding package for a new product line. The amount of time it takes that marketing consultant to complete the project will be based on their familiarity of the industry and experience level. Creating a project-based rate helps to minimize extraneous logged hours. This doesn’t mean project-based contracts lack deadlines. It just means that the value of the project is predetermined; the amount of time it takes the contractor to complete the work is to their discretion.

While most freelancers will fall into one category or the other, some may prefer a hybrid of the two rate structures. In this scenario, the contractor will have a base-rate for the initial project agreement, but will bill an hourly rate for additional requests. Alternatively, some contractors have different rates for different types of work. For example, an independent contractor hired to manage vendors in a large festival can bill a lower rate for pre-production work for 60-90 days leading up to the event, and then bill a premium rate for activation days when the workload and demand are at their highest.

When to Pay Freelancers and Independent Contractors

When you’re processing thousands of payouts monthly, your payment schedule directly impacts both operational efficiency and payee retention. Most high-volume platforms use one of two approaches:

Time-Based vs. Milestone-Based

For contracts that include smaller, redundant tasks or projects that have definitive timelines, time-based payments are a good solution. This is the dominant model for mass payout platforms: creator platforms distribute monthly revenue share to thousands of content creators, gig economy apps pay drivers weekly based on completed rides, and royalty networks disburse quarterly earnings to rights holders. When you’re processing payouts to 10,000+ payees on a recurring schedule, time-based payments allow you to batch process disbursements programmatically—whether that’s daily, weekly, or monthly cycles.

Another option for payment frequency is milestone-based or event-triggered payments. Milestone-based payments execute when specific conditions are met rather than on a calendar schedule. This type of payment structure is best for longer-running projects, marketplaces, and platforms where payment depends on verification or completion rather than elapsed time. In it’s own way, this type of model creates definitive deadlines while allowing for longer lead times for fulfillment. This structure can be used for marketplaces where sellers are paid when buyer confirms delivery or for insurance platforms where process claims are sent upon approval.

Many platforms combine both approaches: regular time-based cycles for standard payouts with milestone-based payments for special circumstances such as bonuses, refunds, or expedited payments.

Collect a W-9 Form

An important and often overlooked step when hiring a freelancer is requesting a completed form W-9 in the onboarding process. The W-9 form includes federally identifying information: a Taxpayer Identification Number (TIN)—or Universal Business Identification number (UBI)— assigned to a sole proprietor, but can also be a social security number. Other information on the form includes: the business name, the business address, the type of business (sole-proprietor, LLC, etc.), and certification of information. For more details, see our comprehensive guide on requesting a form W-9.

Collect a W-8 Form for International Contractors

If you’re paying freelancers or independent contractors outside the United States, you’ll need to collect a W-8 form instead of a W-9. W-8 collection handles the various form types (W-8BEN, W-8BEN-E, W-8ECI) that establish foreign status and potential treaty benefits for withholding relief.

Legal Implications

Minimum Wage and Other Labor Laws Might Not Apply

Gig work—another term for freelancers and independent contractors—is a hot ticket item right now as app-based workers seek to ensure sustainable wages, healthcare, and unionization rights. These discussions point to how best to define what is meant by the term “employee” with the biggest question being how integral to overall profitability is the performance of a gig worker. Legislation in the US congress will seek to determine and enforce these definitions.

For now, minimum wage and labor laws do not apply to freelance and independent contractors. This can be a challenge for freelancers, but strategically written contracts and negotiation can ensure protections and expectations in most instances. Best practice would be to work with your pool of contractors to create an environment that is sustainable for both the business and the freelancer. Most independent contractors are doing work they enjoy and are passionate about, and agreeing to a sustainable and fair rate and payment terms will result in high quality, consistent outcomes.

Don’t Withhold Payroll Taxes

Simply put, do not withhold employer taxes from the contractor’s pay. Sole proprietor business owners are responsible for filing their own self-employment tax and income taxes. They are responsible for paying into Social Security and Medicare when they file taxes throughout the year. They are estimated quarterly and reconciled at the end of the year when 1099-NEC forms are filed with the IRS.

Sending a 1099-MISC (1099-NEC) by February 2

If your business worked with independent contractors during the year, you are legally required to provide tax documentation to contractors by February 2. Form 1099-NEC must also be filed with the IRS by February 2, while Form 1099-MISC is due to the IRS by March 31 if filed electronically. Beginning with the 2020 tax year, payments to self-employed individuals are reported on Form 1099-NEC instead of 1099-MISC, and starting in 2026, the reporting threshold will increase from $600 to $2,000 due to recent tax law changes.

A freelancer collects each of these documents from their clients and uses them to file taxes. Unlike employees who have taxes withheld each pay period, self-employed individuals must determine what they owe and make those payments, usually quarterly, directly to the IRS. Failure to send a 1099-NEC to a contractor or to the IRS will result in fines.

For international contractors, you’ll need to file a Form 1042-S instead of a 1099, which reports payments made to foreign persons and any tax withheld.

Backup Withholding When There’s No SSN or TIN

To ensure that self-employed individuals are accurately reporting earnings, the IRS may send a business who is making payments to non-employee a “B” notice. This is an indication that the tax identification number (TIN) or social security number (SSN) for the non-employee is missing or does not match IRS records. If this happens, the business should first send a notice to the individual to provide an updated W-9 form. If the number continues to be unverified by the IRS, the business is required to withhold 24% of payments made to the self-employed individual. This amount is recorded on the 1099-NEC form.

Payment Methods

There are many ways to pay your freelancer for their work. Each method has its own benefits and drawbacks.

Instant Payments (RTP/FedNow)

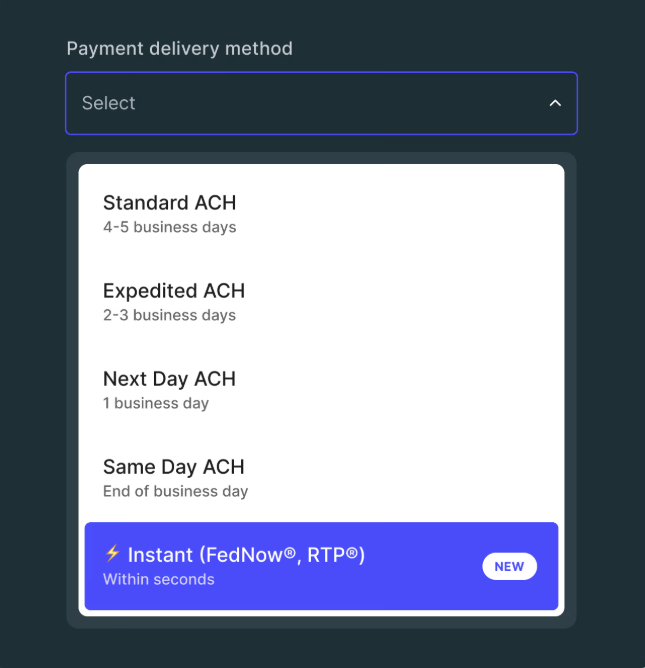

Instant payments allow funds to move instantly between bank accounts, 24/7/365. Unlike ACH or wire transfers, which can take days to settle and are limited to business hours, real-time payment rails clear and settle transactions in seconds, with immediate confirmation for both sender and recipient.

ACH Transfers

To say that ACH payments are increasingly popular is putting it lightly. As of Q1 2025, ACH payment volume rose 4.2% to 8.5 billion with the value reaching $22.1 trillion, showing consistent growth in this fast, secure payment option for B2B payments and direct deposits.

Payments made using the Automated Clearing House batch at different intervals throughout the day, and are deposited directly into a payee’s account within a matter of days if not same-day.

Wire Transfers

With similar speed and security of ACH payments, wire transfers continue to be a beneficial payment method, especially for international B2B contracts. Further, wire transfers can be made with cash through services like Western Union. Processing fees are a drawback for wire transfers as they tend to occur both when initiated as well as by the receiving bank impacting the actual deposited amount.

Checks

Checks are still an important payment method. Checks offer oversight and control for payment processing and can be used for large amounts that other payment options cannot accommodate. Accepting check payments doesn’t require a bank account and is specific to the payee helping to minimize fraud. However, checks take much longer to receive and process than other methods, sometimes 7-10 business days from the time it is mailed to the time it is processed.

Credit cards

Payments made with credit cards can be helpful when cash flow isn’t available when payment is due. Not every freelancer will be able to accept credit card payments, but online payment platforms help ease that burden. Credit card payments are subject to transaction fees which can result in a markup on project cost.

Online payment systems

E-commerce payment processing platforms like Apple Pay and Google Pay are user friendly and fast. Most importantly, they provide encryption that protects sensitive financial information unlike other payment processing options that require verification of account and routing numbers, in addition to personal identification numbers before payment can be initiated.

Freelancers are a vibrant group, a growing workforce, and could be the best solution for offsetting employee workload to complete projects. Whether you’re looking to staff an event, migrate to new software, improve social media engagements, or spruce up a new space with the help of a local artist, working with independent contractors can enrich your workforce without the costs and risks of hiring additional staff.

Speed up Business Payments with Routable

If your head is spinning a bit, we get it. That’s why Routable works directly with SMB to enterprise businesses to make B2B payments simple, secure, and reliable. Users enjoy the high-touch adoption customer support that Routable teams offer and contractors benefit from fast onboarding and faster payments. To learn more, schedule a demo with us.

FAQ

How do I determine whether to pay a freelancer hourly or project-based?

Use hourly rates when you have a defined timeline or specific work windows (like event staffing), and project-based rates for open-ended work where the deliverable matters more than time spent (like branding packages or website redesigns).

What’s the difference between a 1099-NEC and a W-9 form?

A W-9 is collected during onboarding and contains the freelancer’s tax identification information, while a 1099-NEC is the form you must send to both the freelancer and IRS by February 2 documenting total payments made during the tax year.

What payment method gets money to freelancers fastest?

ACH transfers and online payment systems are the fastest options, with same-day ACH available in many cases, while checks can take 7-10 business days from mailing to processing.

Can I withhold payroll taxes from independent contractor payments?

No, you should never withhold employer taxes from contractor payments. Freelancers are responsible for filing their own self-employment tax, income taxes, and quarterly estimated payments to the IRS.

How can I handle 10,000+ monthly freelancer payouts without adding staff?

API-first payment infrastructure automates mass payouts through programmatic batch processing, letting you scale from hundreds to thousands of monthly disbursements without manual intervention or additional headcount.